XM has earned a strong reputation among traders in Qatar for its transparent pricing, flexible account structure, and commitment to education. Operating since 2009 and regulated by CySEC, ASIC, and the IFSC, XM offers a secure environment where both beginner and professional traders can access global financial markets confidently.

The platform provides more than 1,000 tradable instruments, including Forex pairs, commodities, stock CFDs, equity indices, precious metals, and energy assets. This diversity allows traders in Qatar to build well-balanced portfolios and manage risk across multiple asset classes. XM’s infrastructure is designed for fast execution, stable pricing, and seamless order processing — essential qualities for active day traders and investors alike.

Why XM Is Popular Among Traders in Qatar

- Educational Resources and Training

XM stands out for its comprehensive educational ecosystem. Traders can access webinars, daily analysis, live sessions, and video tutorials in Arabic and English. This support helps beginners in Qatar gain practical knowledge of market behavior, technical indicators, and trading psychology before switching to a live account. - Flexible Account Types

XM provides several account options, including Micro, Standard, Ultra Low, and Shares Accounts. Each caters to a specific trading style. For example, Micro accounts allow smaller positions with low deposits, while Ultra Low accounts are preferred by advanced traders seeking minimal spreads and high-speed execution. - Islamic (Swap-Free) Accounts

For Muslim traders, XM offers swap-free accounts that comply with Sharia law. These accounts eliminate overnight interest (swap) fees, allowing local traders in Qatar to participate in the financial markets ethically and legally. - Localized Support and Payment Options

XM supports Qatari Riyal (QAR) deposits and withdrawals via credit/debit cards, bank transfers, and e-wallets. Payments are processed quickly, and there are no hidden transaction fees. Additionally, customer service in Arabic is available 24/5 through live chat, phone, or email.

XM Account Types Overview

| Account Type | Minimum Deposit | Spreads From | Commission | Leverage (up to) | Best For |

|---|---|---|---|---|---|

| Micro Account | $5 | 1.0 pips | None | 1:1000 | Beginners testing small trades |

| Standard Account | $5 | 1.0 pips | None | 1:1000 | Intermediate traders |

| Ultra Low Account | $50 | 0.6 pips | None | 1:1000 | Scalpers and professionals |

| Shares Account | $10,000 | Based on market | Commissioned | 1:1 | Equity investors |

Each account type offers negative balance protection, ensuring traders never lose more than their deposit. The Ultra Low account, in particular, is favored by active traders in Qatar due to its tight spreads and fast order execution.

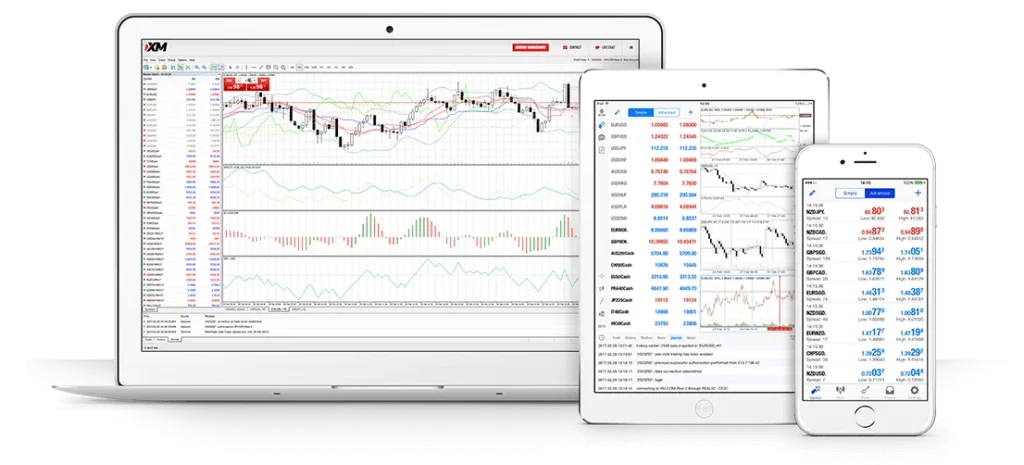

Trading Platforms and Tools

XM supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop, web, and mobile. These platforms include all standard and advanced features such as:

- One-click trading;

- Dozens of built-in indicators and charting tools;

- Access to Expert Advisors (EAs) for automated strategies;

- Real-time market depth and execution reporting.

The XM mobile app mirrors the functionality of its desktop version, giving traders in Qatar the ability to open, manage, and monitor positions on the go.

In addition to standard tools, XM also provides:

- Daily technical and fundamental reports;

- Market sentiment indicators;

- Economic calendar with regional time settings;

- Free VPS hosting for eligible clients.

Deposit and Withdrawal Options for Qatari Traders

Deposits are processed instantly, while withdrawals usually take less than 24 hours. XM covers all transaction costs, which means traders receive the full amount without hidden deductions.

| Payment Method | Deposit Time | Withdrawal Time | Currency Supported | Fees |

|---|---|---|---|---|

| Bank Transfer | Within 24 hours | 1–2 days | QAR, USD | None |

| Credit / Debit Card | Instant | 24 hours | QAR, USD | None |

| Skrill / Neteller | Instant | Instant | USD, EUR | None |

| SticPay / WebMoney | Instant | 1–2 hours | USD | None |

The ability to transact in Qatari Riyals simplifies account management and reduces conversion costs, which is particularly important for local traders who wish to maintain financial efficiency.

Why XM Appeals to Qatari Traders

XM’s focus on education, fairness, and localized accessibility makes it a preferred choice for traders in Qatar. The broker has tailored its services to fit regional expectations — from Arabic language interfaces to Sharia-compliant accounts and local payment integration. Its balanced approach between affordability and professional-grade features enables traders of all skill levels to engage with the global financial market responsibly.

For beginners, the combination of demo accounts, webinars, and micro trading lots provides a low-risk entry point. For professionals, the tight spreads, reliable platforms, and advanced order execution create an ideal environment for long-term trading success.