Plus500 is one of the most recognized CFD brokers globally, known for its clear and fixed pricing model. The company operates under strict oversight from top-tier regulators such as the FCA (UK), CySEC (Cyprus), and ASIC (Australia). As a publicly listed company on the London Stock Exchange, Plus500 maintains full transparency in its operations, which adds credibility and safety for traders in Qatar.

Market Coverage

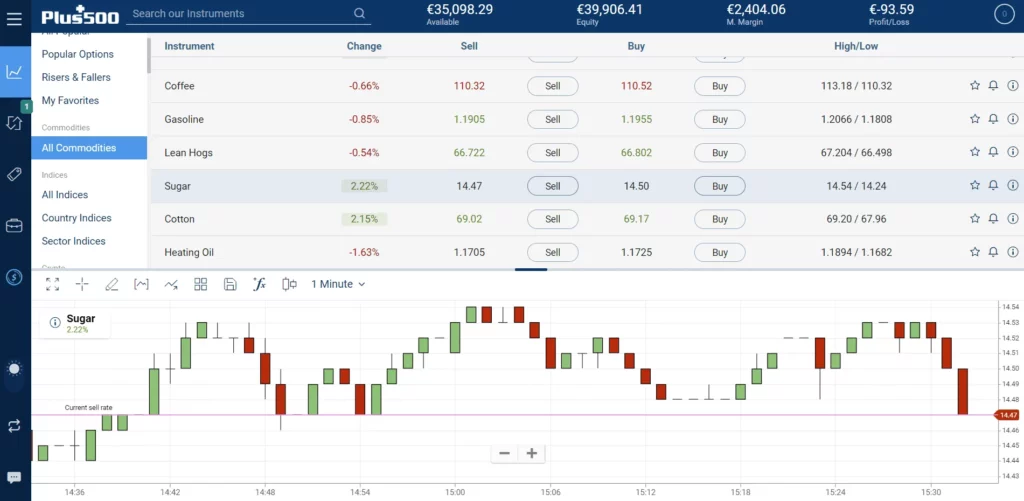

Plus500 provides a wide range of Contracts for Difference (CFDs) across key financial markets:

- Forex: Major, minor, and exotic pairs including USD/QAR, EUR/USD, GBP/USD.

- Stocks: Access to shares of major companies like Apple, Tesla, and Amazon.

- Indices: Popular choices such as NASDAQ 100, FTSE 100, and DAX.

- Commodities: Trade gold, silver, oil, and agricultural products.

- ETFs and Cryptos: CFDs on global ETFs and digital currencies such as Bitcoin and Ethereum.

This variety allows Qatari traders to diversify their portfolios without needing multiple accounts or brokers.

Platform and Trading Features

The Plus500 WebTrader and mobile app are built for speed, simplicity, and reliability. The platform allows quick execution with minimal slippage. Key features include:

- Price alerts and real-time notifications.

- Stop Loss and Take Profit tools for automatic order control.

- Two-step authentication for secure logins.

- Risk management tools such as guaranteed stop orders.

- Negative balance protection to safeguard trader capital.

Accessibility for Qatari Users

Plus500 provides Arabic language support, making it convenient for Qatari users to operate the interface comfortably. Deposits and withdrawals can be made via bank transfers, Visa/MasterCard, or local e-wallets supported in the region.

The broker’s customer support is also available in Arabic and English, helping Qatari traders solve technical or account-related issues quickly.

Account Types and Minimum Deposit

Plus500 offers a single, unified account type designed for simplicity. Traders can access all instruments from one account, with no complicated upgrade paths. The minimum deposit starts from $100, making it accessible for beginners while still suitable for professional traders.

For those who wish to practice first, a free demo account with virtual funds is available — no credit card or verification required.

Regulation and Security

Regulation is a major advantage for Plus500. The broker complies with the rules of several respected authorities:

- Financial Conduct Authority (FCA) – UK

- Cyprus Securities and Exchange Commission (CySEC) – EU

- Australian Securities and Investments Commission (ASIC) – Australia

Client funds are held in segregated accounts, meaning the broker cannot use them for operational purposes. Additionally, data encryption and SSL protection are implemented to maintain secure transactions.

Pros and Cons for Qatari Traders

Pros:

- Fixed spreads and transparent fees.

- Arabic interface and regional payment methods.

- Strong regulatory background.

- Fast web and mobile trading access.

- Free demo account for testing strategies.

Cons:

- CFD-only broker (no direct asset ownership).

- No MetaTrader 4/5 integration.

- Limited educational resources for beginners.