eToro is widely regarded as one of the most innovative trading platforms in the world and has a strong presence among traders in Qatar. Its strength lies in social and copy trading, allowing users to automatically mirror the strategies of successful investors. This model appeals to both beginners who want to learn through observation and professionals seeking to share their expertise.

Operating under the regulation of FCA (UK), CySEC (Cyprus), and ASIC (Australia), eToro offers a secure, transparent, and globally compliant trading environment. It gives Qatari traders access to a broad spectrum of financial instruments, including Forex pairs, cryptocurrencies, commodities, ETFs, and global stocks.

Why eToro Appeals to Traders in Qatar

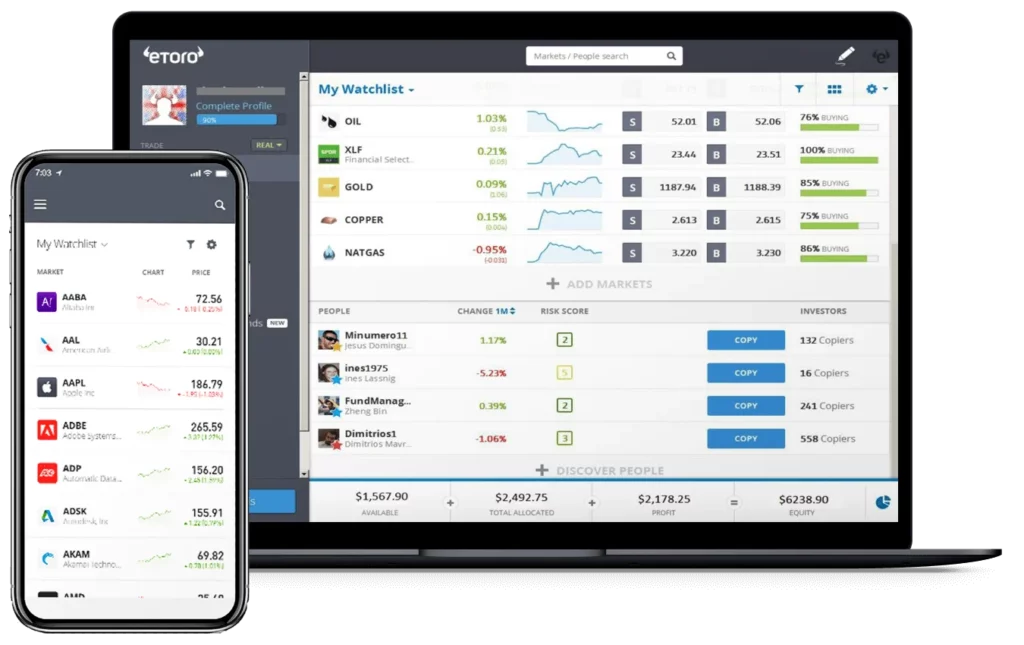

- Copy Trading Technology: eToro’s main innovation is its CopyTrader™ system, which allows users to view the portfolios and performance of experienced traders. With one click, traders can replicate strategies proportionally to their own investment size. This system benefits those who are new to trading but want to learn by observing real market actions.

- Multi-Asset Access: The platform provides exposure to over 3,000 instruments across various markets. Qatari traders can diversify their portfolios by investing in Forex, stocks, indices, commodities, ETFs, and popular cryptocurrencies such as Bitcoin, Ethereum, and XRP.

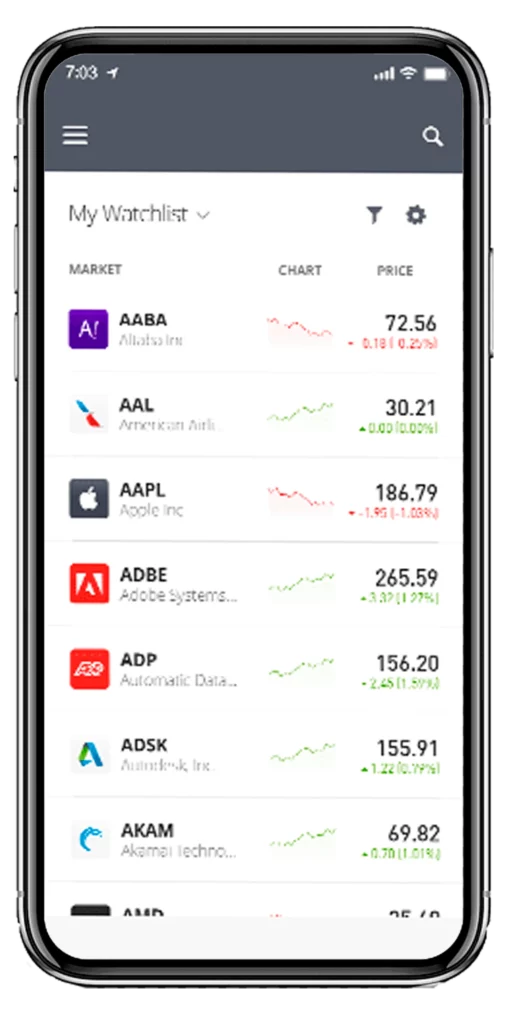

- User-Friendly Interface: The web and mobile platforms are designed for simplicity. Users can monitor trades, track returns, and execute transactions efficiently. Charts, indicators, and risk analysis tools are displayed clearly, helping traders make fast, data-driven decisions.

- Social Trading Community: eToro has built one of the largest global trading communities. Traders can communicate, share insights, and follow top performers directly from the platform. This collaborative approach has made eToro a favorite for those who value transparency and shared experience.

- Arabic Language and Islamic Accounts: eToro supports Arabic as a platform language and offers swap-free Islamic accounts, allowing Qatari traders to operate under Sharia-compliant conditions. Deposits and withdrawals can be made in Qatari Riyals (QAR) via cards, local bank transfers, and e-wallets.

eToro Account Options

| Account Type | Minimum Deposit | Spreads From | Commission | Best For |

|---|---|---|---|---|

| Retail Account | $200 | From 1.0 pips | None (built into spreads) | General traders |

| Professional Account | $2,000 | From 0.6 pips | Variable on CFDs | Experienced users |

| Islamic Account | $200 | From 1.0 pips | None | Sharia-compliant trading |

All accounts include real-time quotes, negative balance protection, and access to CopyTrader™. The Islamic version removes overnight swap fees, aligning with the ethical requirements of Muslim investors.

Trading Platforms and Tools

eToro provides a single unified platform available on web browsers and mobile devices (Android and iOS). Features include:

- CopyTrader™ – copy strategies from top investors;

- Smart Portfolios – long-term themed investment bundles (e.g., tech stocks, green energy);

- Advanced charting tools – with multiple timeframes and technical indicators;

- Stop Loss and Take Profit – built-in risk management automation;

- Two-factor authentication (2FA) – for enhanced account security.

eToro also offers educational resources such as webinars, trading guides, and market analysis, all accessible in Arabic and English.

Deposit and Withdrawal Methods for Qatari Traders

| Payment Method | Deposit Time | Withdrawal Time | Supported Currency | Fee |

|---|---|---|---|---|

| Bank Transfer | 1–3 days | 2–5 days | QAR, USD | None |

| Visa / MasterCard | Instant | 1–2 days | QAR, USD | None |

| Skrill / Neteller | Instant | 1 day | USD, EUR | None |

| PayPal | Instant | 1–2 days | USD | None |

| Crypto Wallet (for withdrawals) | Within 1 hour | Within 1 hour | BTC, ETH, USDT | Network fee only |

eToro supports instant deposits and fast withdrawals, making it practical for Qatari traders who require quick fund transfers.

Why eToro Stands Out for Qatari Investors

eToro combines community-driven investing with a reliable and regulated structure. For Qatari traders, the platform’s Islamic account options, Arabic interface, and local funding solutions make it one of the most accessible brokers available. The ability to observe, copy, and learn from global experts creates real value for both new and experienced traders in Qatar.

Its balance of technology, education, and compliance positions eToro as a powerful option for anyone looking to expand their investment portfolio beyond traditional markets.