Exness, a leading forex and CFD broker, provides a wide array of financial instruments to traders. Among the indices available for trading is the NASDAQ-100, commonly referred to as NAS100. This index represents the top 100 non-financial companies listed on the NASDAQ stock exchange, including prominent tech giants like Apple, Microsoft, and Amazon.

Availability of NAS100 on Exness

The NAS100 is available as a Contract for Difference (CFD) on Exness. Traders can speculate on the price movements of this index without owning the underlying assets. Here’s a breakdown of the key details regarding NAS100 trading on Exness:

| Feature | Details |

| Trading Platform | Available on MT4 and MT5 platforms. |

| Instrument Symbol | NAS100 or similar variations depending on the platform and account type. |

| Spreads | Competitive, starting from 1 pip depending on account type and market conditions. |

| Leverage | Flexible, with leverage up to 1:2000 for certain account types and jurisdictions. |

| Trading Hours | Aligned with the NASDAQ market, generally 09:30 AM to 4:00 PM EST (Monday to Friday). |

| Contract Size | Typically based on 1 lot = $10 per point movement in the index. |

| Margin Requirement | Calculated dynamically based on the account leverage and position size. |

| Swap Fees | Applicable for positions held overnight, but swap-free options may be available. |

Benefits of Trading NAS100 on Exness

- Access to Leading Tech Stocks: NAS100 allows exposure to major tech companies that often outperform broader markets.

- High Liquidity: The NASDAQ-100 is one of the most actively traded indices globally, ensuring tight spreads and smooth order execution.

- Advanced Trading Tools: Exness offers advanced analytical tools and risk management features on MT4/MT5, such as stop-loss and take-profit orders.

- Customizable Leverage: Adjust leverage to align with your trading strategy and risk tolerance.

- Regulated Environment: Trade in a secure environment under the supervision of multiple financial regulators.

How to Trade NAS100 on Exness

To trade NAS100, follow these steps:

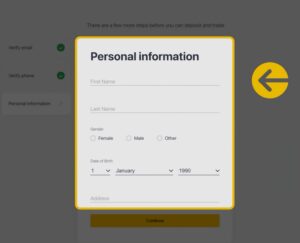

Step 1: Open an Account

Begin by creating an Exness account:

- Visit the Exness website.

- Click the registration button, enter your email, set a password, and select your country of residence.

- Verify your account by uploading a government-issued ID and proof of address. Verification ensures compliance with global trading regulations and secures your account.

Step 2: Select an Account Type

Choose an account type that aligns with your trading goals:

- Standard Account: Best for beginners, offering low spreads and no commission.

- Pro Account: Suitable for advanced traders, providing tighter spreads and faster execution speeds.

Evaluate the features of each account type in your Personal Area before proceeding.

Step 3: Deposit Funds

Add funds to your Exness account:

- Log into your Exness Personal Area.

- Navigate to the Deposit section and select a payment method (e.g., bank transfer, e-wallet, or cryptocurrency).

- Enter the deposit amount, confirm the transaction, and your funds will usually be available instantly.

Step 4: Download the Trading Platform

Set up the platform for trading NAS100:

- Download MetaTrader 4 (MT4) or MetaTrader 5 (MT5) from the Exness website.

- Install the platform on your computer or mobile device, then log in using the credentials provided during registration.

Step 5: Add NAS100 to Market Watch

Prepare NAS100 for trading:

- Open your trading platform and go to the Market Watch section.

- Right-click in the Market Watch window and select Symbols.

- Search for NAS100 or NASDAQ-100, then click Show to add it to your list of instruments.

Step 6: Start Trading

Execute your first NAS100 trade:

- Open a chart for NAS100 by double-clicking its name in the Market Watch list.

- Analyze the market using technical indicators and fundamental data.

- Click New Order, specify your lot size, and decide whether to buy or sell based on your analysis.

- Set stop-loss and take-profit orders to manage your risk effectively.

Example: NAS100 Trading Scenario

Let’s illustrate a NAS100 trade with practical data:

| Parameter | Value |

| Opening Price | 14,500.00 |

| Lot Size | 1 |

| Margin Required | $72.50 (leverage 1:200) |

| Pip Value | $10 per point |

| Target Price | 14,600.00 |

| Profit | $1,000 (100 points) |

Risk Management for NAS100 Trading

Trading NAS100 involves significant risk due to the inherent volatility of the index. To mitigate risks:

- Use stop-loss orders to limit potential losses.

- Avoid overleveraging your positions.

- Diversify your portfolio with other instruments like forex, metals, and energies.

Market Trends Impacting NAS100 Performance

The NAS100 index is heavily influenced by market trends, particularly in the technology sector. Key drivers include advancements in artificial intelligence, cloud computing, and e-commerce. Here’s a snapshot of recent trends and their potential impact:

| Trend | Impact on NAS100 |

| Rise of AI and Machine Learning | Boosts stocks like NVIDIA and Microsoft, driving NAS100 higher. |

| E-commerce Growth | Companies like Amazon and eBay experience revenue growth. |

| Tech Regulation in the US | Stricter policies may introduce volatility in the index. |

| Global Economic Slowdowns | Can cause pullbacks, especially for high-growth tech stocks. |

Staying updated on these trends helps traders anticipate potential market movements and align their strategies accordingly.

Comparison of NAS100 with Other Indices

Traders often compare NAS100 with other major indices to understand its unique characteristics. Below is a comparison of NAS100, S&P 500, and Dow Jones:

| Feature | NAS100 | S&P 500 | Dow Jones (DJIA) |

| Focus | Technology and innovation | Broad market representation | Established blue-chip stocks |

| Volatility | High | Moderate | Low |

| Number of Stocks | 100 | 500 | 30 |

| Top Contributors | Apple, Microsoft, Tesla | Apple, Amazon, JPMorgan | Boeing, IBM, Goldman Sachs |

This comparison underscores NAS100’s focus on high-growth tech companies, making it an ideal choice for traders seeking exposure to innovation.

Advantages of Trading NAS100 CFDs

Trading NAS100 as a CFD on Exness offers several benefits compared to traditional investing:

| Advantage | Description |

| Leverage | Amplify potential gains with lower initial capital. |

| Flexibility | Trade both rising and falling markets. |

| Liquidity | High trading volumes ensure efficient order execution. |

| Hedging Opportunities | Use NAS100 to hedge against tech-heavy portfolios. |

With Exness, traders can fully capitalize on these advantages through its intuitive platforms and competitive trading conditions.

NAS100 Trading Tips for Beginners

For new traders, NAS100 can be an exciting yet challenging instrument. Here are some tips to start:

- Understand the Index: Research its composition and key driving factors.

- Start Small: Use smaller lot sizes to manage risk.

- Leverage Risk Management Tools: Utilize stop-loss and take-profit features on Exness platforms.

- Follow Market News: Stay updated on tech-sector earnings reports and economic indicators.

- Practice with a Demo Account: Familiarize yourself with trading strategies without real financial risk.

By combining these strategies with Exness’ robust tools, beginners can confidently navigate NAS100 trading.

Why Choose Exness for NAS100?

| Feature | Exness Strength |

| Regulation | Regulated by CySEC, FCA, FSCA, and other leading authorities. |

| Low Latency | Ultra-fast order execution speeds, reducing slippage. |

| No Hidden Fees | Transparent pricing with no hidden commissions on most account types. |

| Instant Withdrawals | Access your funds in seconds using automated systems. |

| Educational Resources | Access to webinars, tutorials, and market analysis. |

Trading NAS100 with Exness offers traders an opportunity to engage with one of the most dynamic indices in the global market under advantageous trading conditions.

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQ

What is NAS100?

NAS100, also known as NASDAQ-100, is a major stock index comprising 100 of the largest non-financial companies listed on the NASDAQ stock exchange.