What is an Islamic Account?

In forex trading, traditional accounts involve swap fees, which are interest charges for holding positions overnight. An Islamic account eliminates these fees, making it suitable for Muslim traders who want to engage in forex trading while adhering to their religious beliefs.

Why Choose an Islamic Account at Exness?

Exness offers Islamic accounts tailored specifically for traders who require Sharia-compliant trading conditions. By choosing an Exness Islamic account, you can trade confidently, knowing that your trading activities align with your faith. Exness ensures that its Islamic accounts are free from any interest-based transactions, providing a transparent and ethical trading environment.

Features of Exness Islamic Account

When choosing a forex broker, particularly one that offers Islamic accounts, it’s essential to understand the features and benefits that come with it. Exness stands out as a broker committed to providing Sharia-compliant trading options that cater specifically to the needs of Muslim traders.

No Swap Fees

One of the main features of the Exness Islamic account is the absence of swap fees. This means that traders can hold positions overnight without incurring any interest charges, which is crucial for maintaining compliance with Islamic principles.

Wide Range of Instruments

Exness offers a broad selection of financial instruments available for trading on Islamic accounts. These include forex pairs, commodities, indices, and more, allowing you to diversify your trading portfolio while staying compliant with Sharia law.

Competitive Spreads

Exness Islamic accounts come with competitive spreads, ensuring that you get the best possible pricing on your trades. This allows you to maximise your potential returns while minimising trading costs.

No Hidden Costs

With Exness, what you see is what you get. There are no hidden fees or charges associated with their Islamic accounts. This transparency is part of Exness’s commitment to ethical trading practices, ensuring you can trade with peace of mind.

How to Open an Islamic Account with Exness

Opening an Islamic account with Exness is a straightforward process designed to accommodate the needs of traders who require Sharia-compliant trading options. Whether you are new to trading or an experienced trader looking to align your investments with Islamic principles, Exness makes it easy to get started.

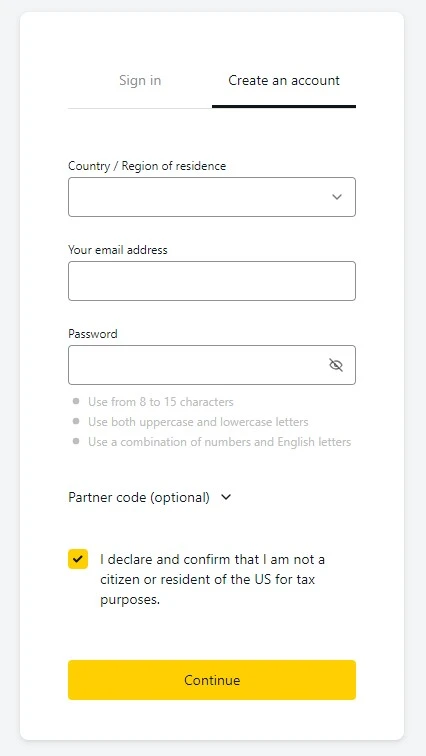

Step-by-Step Guide

- Visit the Exness website and sign up for a Exness new account.

- During the registration process, select the option for an Islamic account.

- Complete the necessary forms and provide the required documentation.

- Once your account is approved, you can start trading immediately.

Verification Process

After registering, you will need to verify your identity by submitting the required documents, such as a government-issued ID and proof of residence. This process ensures compliance with international regulations and helps protect your account.

Islamic Finance Principles Applied to Trading

Islamic finance operates under principles that adhere to Islamic law (Sharia), emphasizing fairness, transparency, and ethical investments. The key tenets include the prohibition of interest (riba), the avoidance of speculation (gharar), and the requirement for transactions to be backed by tangible assets or services. In trading, this means that leveraged trading involving interest (such as rollover or swap fees) is not permissible. Instead, traders must engage in trades that comply with these ethical standards, ensuring that both the transaction itself and the underlying asset are in line with Islamic principles. Additionally, Islamic trading accounts typically offer solutions like “swap-free” options, meaning no interest is charged or earned on positions held overnight.

In practice, traders using Islamic finance principles can participate in forex and other financial markets by avoiding transactions that generate riba, such as paying or receiving interest on leveraged trades. To meet these requirements, brokers like Exness offer Islamic accounts that remove swap fees while providing the same features as standard accounts. These accounts are designed to allow Muslim traders to engage in the financial markets without violating their faith’s principles. As such, the core difference lies in the absence of swap or rollover charges, making them more accessible for long-term trades where interest fees could otherwise accumulate.

Benefits of Trading with Exness Islamic Account

Trading with an Exness Islamic account offers a unique blend of benefits tailored to meet the needs of Muslim traders who wish to adhere to Sharia principles while participating in the global financial markets. Beyond its compliance with Islamic law, Exness provides a range of advantages that enhance the overall trading experience.

Sharia Compliance

Exness Islamic accounts are fully compliant with Sharia law, providing a trading environment free from interest-based transactions. This enables you to engage in forex trading with Exness without compromising your religious beliefs.

Global Market Access

With an Exness Islamic account, you can access global financial markets, trading a variety of instruments while staying compliant with your faith. This global reach ensures that you have plenty of opportunities to grow your investment portfolio.

Advanced Trading Tools

The broker provides access to advanced trading platforms like Exness MetaTrader 4 and Exness MetaTrader 5, equipped with powerful tools and features to enhance your trading experience. These tools include expert advisors, technical indicators, and more.

24/7 Customer Support

The broker offers round-the-clock Exness customer support in multiple languages, including Arabic, ensuring you have the assistance you need whenever you need it.

Comparison of the Exness Islamic with Standard Accounts

| Feature | Exness Islamic Account | Standard Account |

|---|---|---|

| Swap-Free | Yes | No |

| Interest-Free | Yes | No |

| Overnight Rollover Fees | None | Applicable |

| Available Account Types | Pro, Raw Spread, Zero | Standard, Pro, Raw Spread |

| Compliance with Islamic Finance | Yes | No |

Basically, the main difference of the Exness Islamic account from the standard ones is that its core is to follow Islamic principles; thus, it allows the swap-free option to avoid overnight interest fees. Exness Standard accounts, in turn, are open to regular rollover fees, which are found by means of the interest rates of the traded currencies. Both account types allow trading with various financial instruments, but an Islamic account was specifically designed for serving a Muslim trader who cannot afford involvement in interest-based transactions.

FAQs: Exness Islamic Account

What is an Exness Islamic account?

An Exness Islamic account is a trading account that adheres to Sharia law by eliminating swap fees on overnight positions. It is designed for traders who follow Islamic principles and want to avoid interest-based transactions in their trading activities.