Overview of Exness Deposit Options

Exness offers a variety of deposit options to cater to the needs of traders from different regions. Whether you prefer the familiarity of traditional bank transfers, the ease of using credit or debit cards, or the speed and flexibility of e-wallet services like Skrill, Neteller, or Perfect Money, Exness provides multiple convenient choices. Most deposit methods are processed instantly or within minutes, allowing you to fund your account quickly and without unnecessary delays. Additionally, Exness does not charge deposit fees, and minimum deposit requirements vary depending on the selected payment method, making it accessible for traders with different capital levels.

What is a Deposit?

A deposit is the process of transferring funds from your bank account or other payment methods into your Exness trading account. This is the first step to start trading and is crucial for accessing the financial markets.

How to Deposit Funds into Exness

Depositing funds into your Exness account is easy. Log in to your Exness Personal Area, select the deposit method of your choice, enter the desired amount, and follow the on-screen instructions to complete the transaction.

Available Deposit Methods at Exness

Exness provides multiple deposit methods to suit the preferences of traders worldwide. Whether you are in Qatar or any other supported region, you can find a deposit method that works best for you, making it easier than ever to fund your trading account. Each method is designed to offer convenience, security, and speed, allowing traders to choose according to their preferences and needs.

Bank Transfer

Bank transfers are a reliable and secure way to deposit funds into your Exness account. This method is ideal for traders who prefer using their local bank to fund their trading activities. While bank transfers may take a little longer to process compared to other methods, they provide a trusted and widely available option for those dealing with larger amounts or seeking a more traditional deposit route.

Credit/Debit Cards

Credit and debit cards are widely accepted and offer a quick and convenient way to deposit funds into your Exness account. Exness supports various major cards, including Visa, MasterCard, and others, ensuring flexibility for traders around the globe. Deposits made via credit and debit cards are typically processed instantly, allowing you to start trading without delay.

E-Wallets

E-wallets are increasingly popular due to their speed and ease of use. Exness supports several major e-wallet providers, including Skrill, Neteller, and Perfect Money, enabling traders to make instant deposits with minimal fees. E-wallets are especially appealing for traders looking for a fast and seamless deposit experience, and many e-wallet providers also offer convenient withdrawal options, making it a well-rounded choice for online traders.

Local Payment Methods in Qatar

For traders in Qatar, Exness offers local payment methods tailored to the region. These methods are designed to facilitate quick and efficient deposits using familiar local banking options, ensuring that traders can easily fund their accounts without complications.

These include:

- Qatar National Bank (QNB): Direct bank transfers from your QNB account to your Exness trading account are seamless and secure, providing a trusted option for traders who prefer to use their local bank for deposits.

- Doha Bank: Use Doha Bank’s online banking services for quick and secure deposits. This method offers traders a reliable way to fund their accounts with minimal hassle, ensuring smooth transactions directly from their Doha Bank accounts.

- Masraf Al Rayan: Transfer funds directly from your Masraf Al Rayan account into your Exness trading account. This local banking option is ideal for traders who want to maintain the convenience of using a familiar regional bank.

- Local E-Wallets: Depending on the available services in Qatar, you may also have access to local e-wallets that can be used for deposits. E-wallets provide the added benefits of speed and ease, with many offering instant deposits and minimal fees.

How to Make a Deposit at Exness

Making a deposit at Exness is a simple and straightforward process. By following the outlined steps, you can quickly add funds to your trading account and begin your trading journey with ease. Exness offers various deposit options, ensuring that you can choose the method that best suits your needs and preferences.

Step-by-Step Deposit Guide

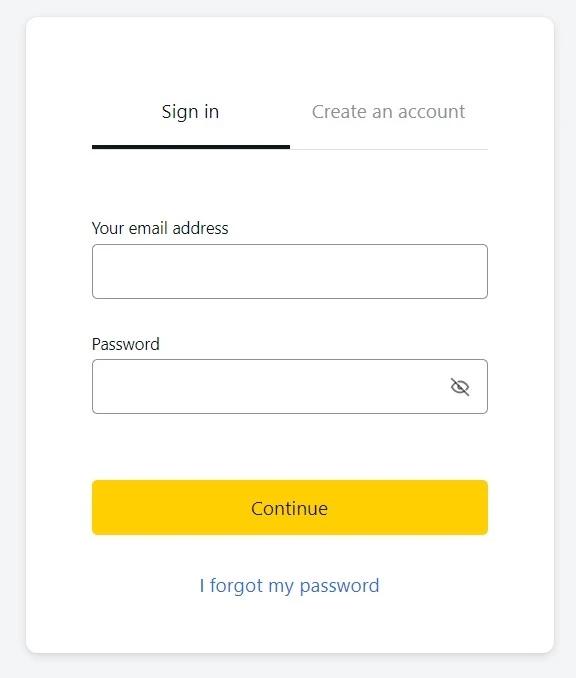

- Log in to your Exness Personal Area.

Access your Exness account by logging into your Personal Area with your username and password. This is where you can manage your account, make deposits, and track your trading activity. - Click on the “Deposit” tab.

Once you’re in your Personal Area, locate and click on the “Deposit” tab. This will take you to the section where you can choose your preferred deposit method. - Select your preferred deposit method.

Exness offers a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets. Choose the option that works best for you, whether you prefer a local or international payment method. - Enter the amount you wish to deposit.

After selecting your payment method, enter the amount you want to deposit into your trading account. Ensure you meet the minimum deposit requirement for the selected method. - Follow the prompts to complete the transaction.

Depending on the deposit method, you may be asked to provide additional information, such as your card details or banking login information. Follow the on-screen instructions to complete the transaction. Once the payment is processed, the funds will be added to your account, and you’ll be ready to start trading.

Verifying Your Payment Method

Before making a deposit, ensure that your payment method is verified. This Exness verification process is crucial for security and compliance with regulatory requirements. Verifying your payment method helps protect both you and the platform from fraud and ensures that all transactions are secure and legitimate. Additionally, this step is required to prevent money laundering and other financial crimes, in line with global regulatory standards.

To verify your payment method, you may need to provide additional documentation, such as proof of identity or a recent bank statement, depending on the payment method you choose. The process is straightforward and typically takes a short amount of time. Once your payment method is verified, you will be able to make deposits without any delays, and you can start trading confidently, knowing that your financial transactions are secure and compliant with Exness’ high standards.

Deposit Limits and Fees

Exness also has its limit and its respective fee, which may vary depending on the payment method and region. Bank wire transfer, for example, might have higher deposit limits but might have additional fees and take longer to credit, while e-wallets like Skrill or Neteller might offer faster deposits with lower fees but might have different transaction limits. It’s crucial to go through the details for each payment option that you have available to make sure you’re satisfying the deposit requirement and not getting any surprise fees. Verifying these details beforehand will ensure that you select the most suitable option for your trading requirements and your budget, resulting in a seamless transaction process with no surprise charges or delays.

| Payment Method | Deposit Limits | Fees | Processing Time |

|---|---|---|---|

| Bank Wire Transfer | Higher limits, varies by region | May include fees, higher fees for international transfers | 1-3 business days |

| Skrill | Varies by region | Low fees, may vary | Instant |

| Neteller | Varies by region | Low fees, may vary | Instant |

| Credit/Debit Cards | Varies by card type | Usually no fees, depending on card type | Instant |

Deposit Processing Times at Exness

Understanding the processing times associated with each deposit method is key to planning your trading activities effectively. While methods such as credit/debit cards and e-wallets like Skrill or Neteller offer instant deposits, allowing you to begin trading immediately, bank transfers typically take longer, ranging from one to three business days depending on the bank and location. Being aware of these processing times ensures you can manage your funds and trading strategy efficiently, making sure you’re prepared for any trading opportunities without unnecessary delays.

General Processing Time for Each Method

The processing time for deposits varies depending on the method chosen. For instance, e-wallets and credit cards typically offer instant processing, while bank transfers may take longer.

Factors Affecting Processing Times

Several factors can influence the processing time of your deposit, including the payment method, the time of day, and any potential bank holidays.

Common Issues with Exness Deposit

While Exness strives to provide a seamless deposit experience, issues can occasionally arise. Being aware of common problems and their solutions can save you time and frustration, allowing you to resolve any issues quickly and continue with your trading activities.

Why is My Deposit Delayed?

Delays in deposits can occur due to several reasons, such as incorrect payment details, bank processing times, or system maintenance. Sometimes, a discrepancy in the payment information, such as a misspelled name or an incorrect account number, can lead to delays. Additionally, certain payment providers or banks may require more time to process the transaction. It’s essential to double-check your payment details before confirming your deposit and to be patient while waiting for the deposit to be processed. If the delay persists for an unusually long time, you can reach out to Exness support for assistance.

What to Do if a Deposit is Not Reflected

If your deposit is not reflected in your Exness account, first ensure that the transaction was successful from your payment provider’s end. Check your payment provider’s dashboard or transaction history to verify that the funds were transferred. If the payment was processed successfully but the funds haven’t appeared in your Exness account, contact Exness support for further assistance. They can help you track the issue and ensure your funds are properly credited to your account.

Exness Support for Deposit Queries

Exness offers comprehensive support to address any issues related to deposits. Their Exness customer support team is available 24/7 to help you resolve any queries promptly.

Ready to Trade? Begin Funding Your Account with Ease

Explore More About Exness Services

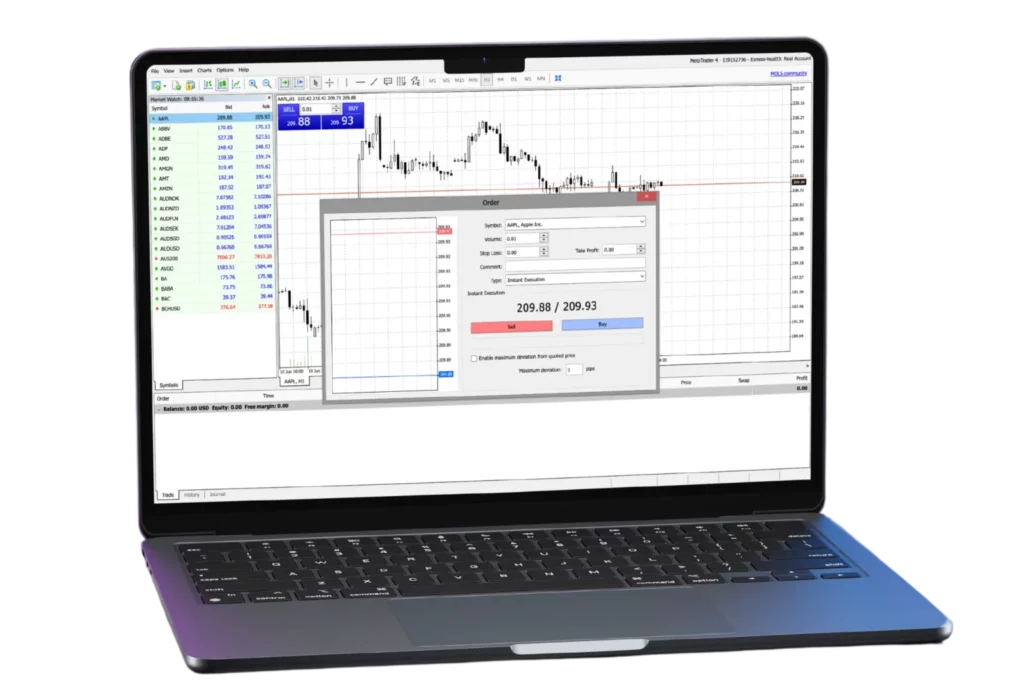

Exness offers a range of services to improve your trading experience. It provides easy deposit options through local and international payment methods, including choices for Qatar traders. Fast and secure withdrawals are ensured. Traders use advanced platforms like Exness MetaTrader 4 (MT4), Exness MetaTrader 5 (MT5), and the Exness Trader app. Support tools such as webinars, tutorials, and market analysis are available. Multilingual customer support is provided 24/7 to assist with all your trading needs.

So, you can easily trade forex, crypto, stocks, indices, and commodities with Exness, benefiting from seamless transactions, powerful platforms, and expert support.

FAQs: Exness Deposit

How can I change my deposit method?

To change your deposit method, log in to your Personal Area, select a new method under the deposit options, and follow the instructions. Make sure your new payment method is verified before use.