What is the Exness Trading Calculator?

The Exness Trading Calculator is a powerful tool designed to help traders evaluate different aspects of their trades before executing them. It allows users to calculate potential profits, margins, pip values, and swap fees, giving them a clearer picture of what to expect from their trades. This tool is particularly useful for traders in Qatar, where market conditions and financial regulations can influence trading outcomes.

Why Use a Trading Calculator?

Using a trading calculator is crucial for several reasons. First, it helps traders accurately estimate potential profits or losses, ensuring they have a realistic expectation before entering a trade. It also aids in effective risk management by calculating the required margin and potential exposure, allowing traders to plan their investments wisely. Additionally, it saves time by automating complex calculations, enabling traders to focus on strategy development and market analysis.

Types of Calculators Available at Exness

Exness provides a range of calculators to cater to the diverse needs of traders. Each calculator is designed to simplify different aspects of trading, ensuring that traders have all the tools they need to succeed.

Profit Calculator

The Profit Calculator helps traders estimate the potential profit or loss from a trade. By inputting details like the trading instrument, account type, trade size, and leverage, traders can quickly see how much they stand to gain or lose, allowing them to make more informed decisions.

How to Use the Profit Calculator:

- Select the trading instrument (e.g., EUR/USD, XAU/USD).

- Choose your account type (Standard, Pro, etc.).

- Enter the trade size in lots (e.g., 1 lot = 100,000 units for forex).

- Specify the leverage ratio.

- Input the opening and expected closing prices.

Example: Trading EUR/USD

- Account Type: Standard

- Instrument: EUR/USD

- Lot Size: 1 lot (100,000 units)

- Leverage: 1:100

- Opening Price: 1.1000

- Closing Price: 1.1050

Result: The Profit Calculator shows a profit of $500 if the price moves in the trader’s favor. If the price moves against the position, the potential loss will also be calculated, enabling effective risk management.

Margin Calculator

The Margin Calculator is essential for determining the amount of margin required to open a position. This tool is particularly useful for managing risk, as it helps traders understand how much capital is needed to maintain their trades and avoid margin calls.

How to Use the Margin Calculator:

- Select the trading instrument (e.g., XAU/USD, GBP/JPY).

- Enter your account currency (e.g., USD).

- Input the lot size.

- Specify the leverage ratio.

Example: Trading Gold (XAU/USD)

- Instrument: XAU/USD

- Account Currency: USD

- Lot Size: 0.5 lot (50,000 units)

- Leverage: 1:200

Result: The calculator determines the margin requirement to be $250. This ensures you have enough funds in your account to open the position and helps you manage your trading capital effectively.

Pip Calculator

The Pip Calculator is used to calculate the value of a pip in the currency of the trader’s account. This is important for understanding how price movements will affect the overall trade, allowing traders to better assess potential gains or losses.

How to Use the Pip Calculator:

- Choose your currency pair (e.g., GBP/JPY).

- Enter your account currency.

- Input the lot size.

- The calculator will display the pip value in your account currency.

Example: Trading GBP/JPY

- Currency Pair: GBP/JPY

- Account Currency: USD

- Lot Size: 1 lot (100,000 units)

Result: The Pip Calculator shows that a one-pip movement equals $8.50. If the price moves 50 pips in your favor, your profit would be $425. This level of clarity enables traders to measure risk and plan their trades more effectively.

Swap Calculator

The Swap Calculator calculates the swap fee that will be charged or earned on a trade held overnight. This helps traders to factor in these costs when planning long-term positions, ensuring a more accurate profit/loss calculation.

How to Use the Swap Calculator:

- Select the trading instrument (e.g., USD/JPY, EUR/USD).

- Enter the lot size.

- Choose your account type.

- Input the swap rate (positive or negative).

Example: Holding USD/JPY Overnight

- Instrument: USD/JPY

- Lot Size: 2 lots (200,000 units)

- Swap Rate: -2.5%

Result: The Swap Calculator indicates an overnight cost of $50 for holding the position. This allows traders to factor in swap charges when calculating their net profit or loss for long-term trades.

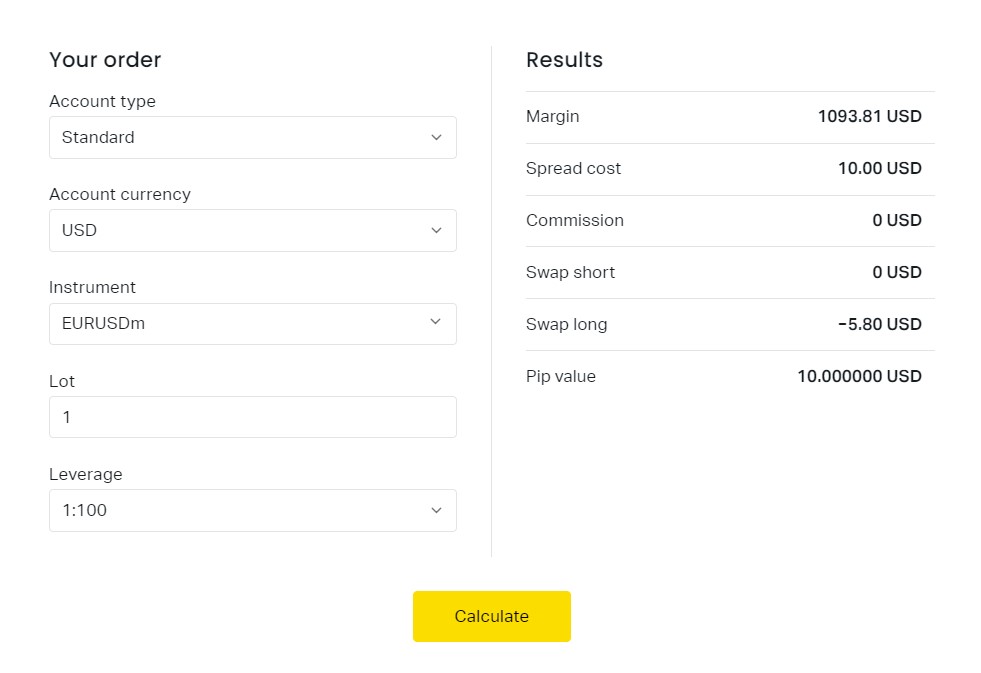

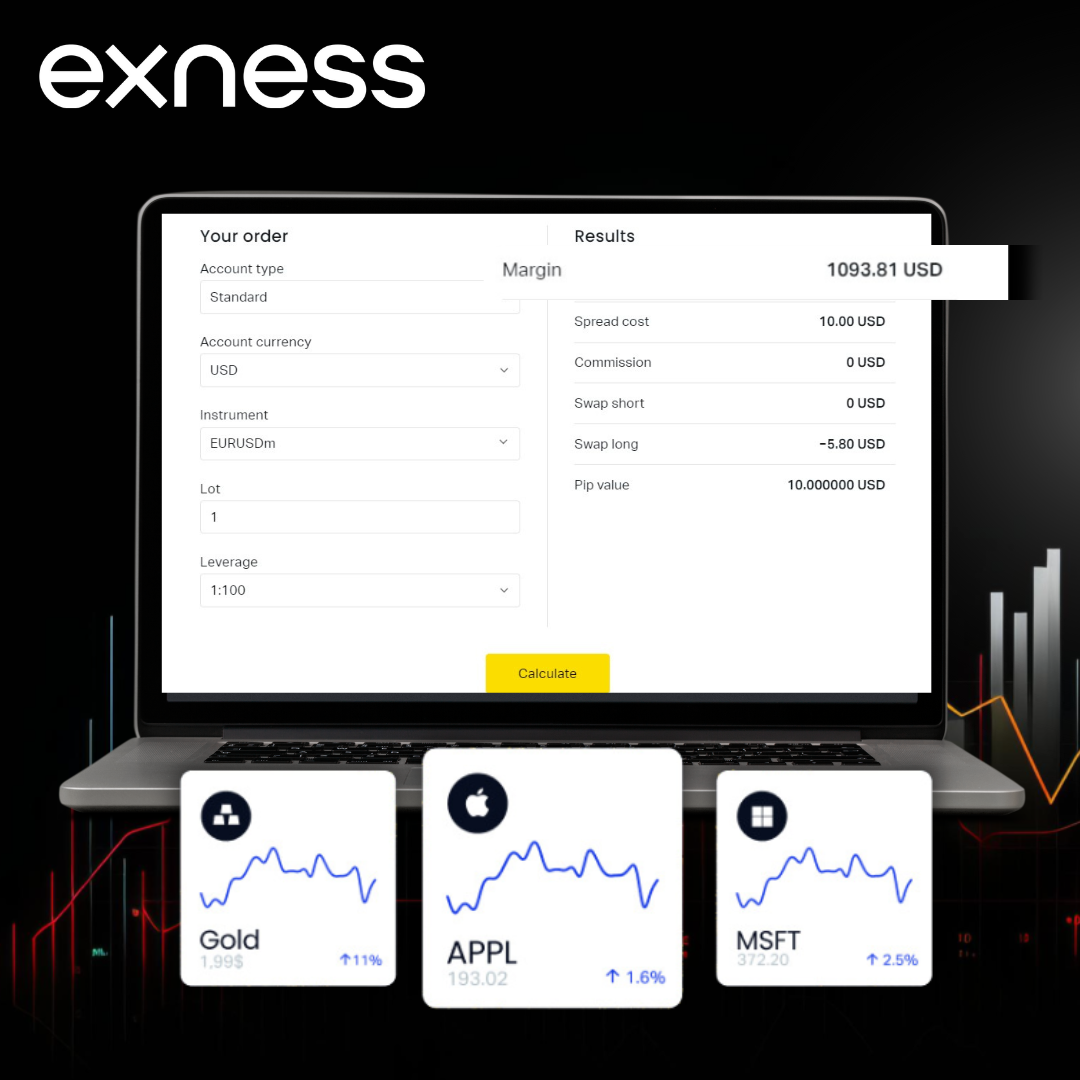

How to Use the Exness Trading Calculator

Using the Exness Trading Calculator is straightforward and user-friendly. Traders simply need to input the relevant details of their trade, such as the Exness trading instrument, trade size, and account type. The calculator will then generate the necessary values, helping traders to make informed decisions quickly and efficiently.

- Open the Exness website and access the Trading Calculator tool.

- Choose your financial instrument like EUR/USD, Gold, or NASDAQ.

- Enter your trade size in lots (e.g., 1.0 lot).

- Select your Exness account type: Standard, Pro, Zero, etc.

- Set leverage (e.g., 1:100).

- Input the opening price (e.g., 1.1800) and closing price (e.g., 1.1900).

- Add Stop Loss (e.g., 1.1750) and Take Profit (e.g., 1.1950) levels.

- Check the margin required, potential profit/loss, swap fees, and pip value.

- Adjust your inputs if needed and recalculate.

- Use the results to make your final trading decision.

Benefits of Using the Trading Calculator

The Exness Trading Calculator offers numerous benefits that enhance the trading experience, making it an indispensable tool for anyone looking to optimise their trading strategies.

Accurate Profit Estimations

One of the primary benefits of the trading calculator is its ability to provide accurate profit estimations. By inputting all relevant variables, traders can see potential profits, helping them to make more informed decisions and set realistic targets.

Efficient Risk Management

Risk management is crucial in trading, and the Exness Calculator helps traders manage their risk more effectively. By calculating the necessary margin and potential exposure, traders can plan their investments carefully and avoid unexpected losses.

Time-Saving Tool

The Exness Calculator saves traders time by automating complex calculations. This allows traders to focus on other important aspects of trading, such as market analysis and strategy development, rather than spending time on manual calculations.

Enhanced Trading Strategy

With accurate and reliable data from the trading calculator, traders can refine their strategies to better suit market conditions. This leads to more efficient and successful trading, as strategies can be adjusted based on precise calculations.

Real-Time Scenario Analysis

Another unique advantage of the Exness Trading Calculator is its ability to support real-time scenario analysis. Traders can simulate multiple “what-if” scenarios by adjusting variables like leverage, lot size, or currency pair. This helps them:

- Experiment with strategies without risking real money.

- Anticipate outcomes under different market conditions.

- Test the impact of potential price movements on profit or loss.

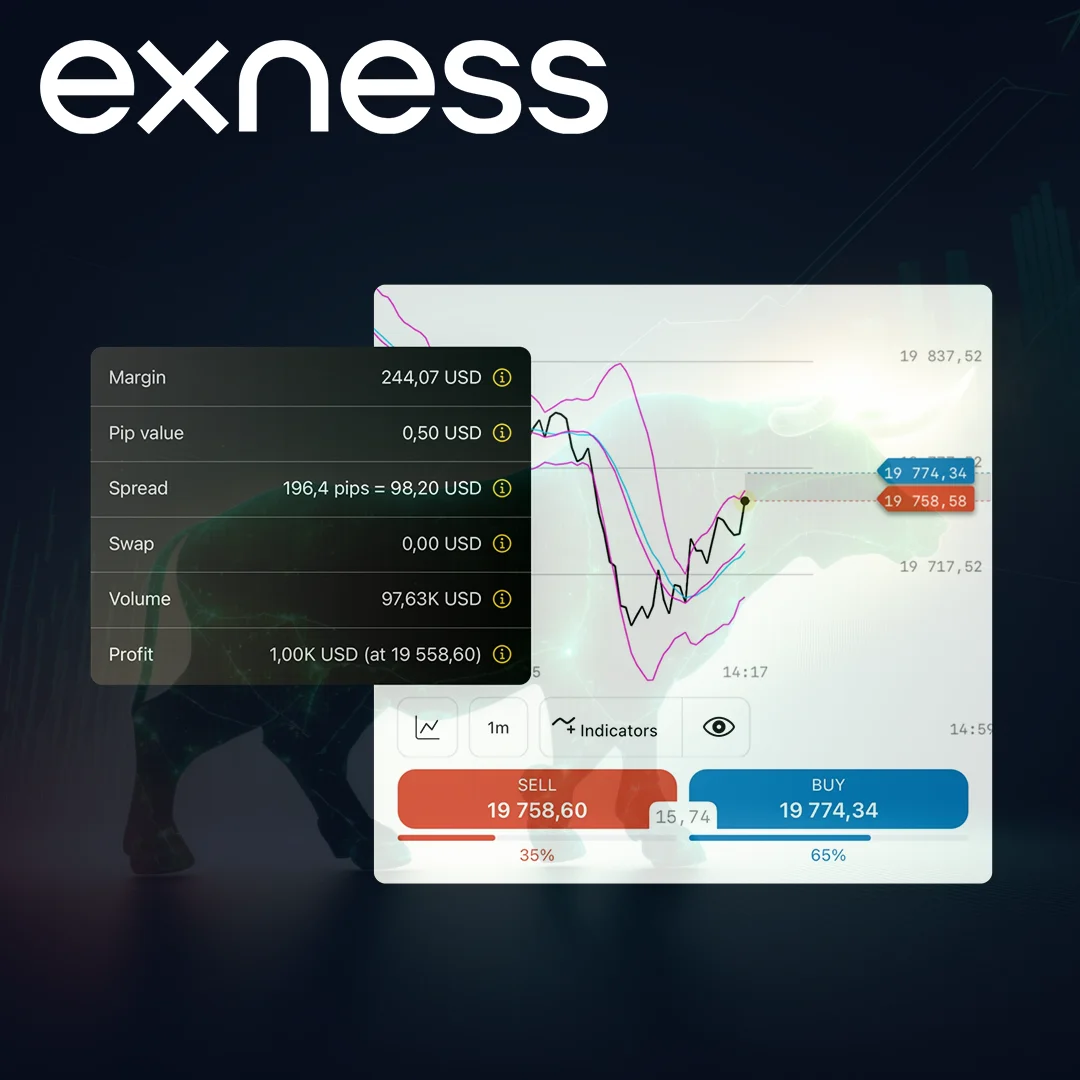

Here are the Exness trading platforms where you can calculate potential profits, margin, and other trade details:

Examples and Scenarios of Using Exness Calculator

To fully understand the benefits of the Exness Calculator, it is helpful to look at some practical examples and scenarios. These examples will demonstrate how the calculator can be used to optimise trading decisions in real-world situations.

Trading Gold (XAU/USD)

A trader is interested in trading gold, predicting that the price of gold (XAU) will rise against the US Dollar (USD). The trader wants to calculate the potential profit and margin requirements before placing a trade. The trader inputs the following details into the Exness Trading Calculator:

- Leverage: 1:200

- Account Type: Pro

- Account Currency: USD

- Instrument: XAU/USD

- Lot Size: 0.5 lot (50,000 units)

Trading GBP/JPY

A trader is analysing the GBP/JPY currency pair and expects the British Pound (GBP) to strengthen against the Japanese Yen (JPY). To prepare for the trade, the trader uses the Exness Trading Calculator to determine the margin, swap rates, and potential profit:

- Account Type: Standard

- Account Currency: USD

- Instrument: GBP/JPY

- Lot Size: 2 lots (200,000 units)

- Leverage: 1:50

Start Optimising Your Trades with Exness Trading Calculator

Using the Exness Trading Calculator can greatly improve your trading results. It provides accurate and timely data, helping you make informed decisions, manage risks, and optimise your strategies. Start using the Exness Trading Calculator today to elevate your trading experience.

FAQs: Exness Calculator

What is a trading calculator?

A trading calculator is a tool that helps traders calculate various aspects of their trades, such as potential profits, required margins, and pip values. It simplifies the process of planning trades by providing accurate calculations based on the trader’s inputs.