When traders compare platforms like Exness and eToro, the goal is to identify which broker fits their strategies, financial goals, and style of execution. Both companies operate globally, but they differ significantly in their account types, fee models, and available assets. A structured comparison makes it easier to highlight these differences and decide which broker aligns better with individual priorities.

Regulation and Safety

The first question most traders ask is about trust. Both companies are regulated, but the jurisdictions vary, which impacts the level of investor protection and legal oversight.

| Broker | Regulators | Investor Protection Features |

| Exness | FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles) | Segregated accounts, negative balance protection |

| eToro | FCA (UK), CySEC (Cyprus), ASIC (Australia), FINRA/SEC (USA) | Investor Compensation Scheme (EU/UK), insurance coverage in certain regions |

Exness is often viewed as stronger in forex regulation, while eToro’s presence in the U.S. market shows a broader geographical coverage. Traders who focus on forex might lean toward Exness, while those interested in regulated equity and crypto trading often consider eToro.

Trading Instruments

Another key difference lies in the range of assets available. Exness concentrates on currency pairs and CFDs, while eToro positions itself as a multi-asset broker with access to global equities and digital currencies.

| Instrument Type | Exness | eToro |

| Forex | 100+ pairs | 50+ pairs |

| Stocks (real) | CFDs only | 3000+ US and international stocks |

| Indices | CFDs | CFDs |

| Commodities | CFDs | CFDs |

| Cryptocurrencies | CFDs only | Real crypto + CFDs |

| ETFs | No | Yes |

This split reflects the brokers’ target audiences. Exness appeals to short-term traders focused on leverage, while eToro attracts investors interested in building long-term equity and crypto portfolios.

Fees and Spreads

Costs directly affect profitability, so examining spreads, commissions, and overnight charges is essential. Exness emphasizes tight spreads on major currency pairs, while eToro uses a commission-free structure for stock trades but adds spreads on forex and crypto.

Exness typical fees:

- Raw spread accounts: spreads from 0.0 pips, commission from $3.50 per lot

- Standard accounts: spreads from 0.3 pips, no commission

- Swap-free options available in some regions

eToro typical fees:

- Stocks and ETFs: zero commission (markup in spread)

- Forex: spreads from 1 pip

- Crypto: spreads start from 0.75%

- Overnight financing on leveraged positions

For short-term forex scalpers, Exness can be more cost-efficient, while eToro’s commission-free stock trading appeals to long-term equity investors.

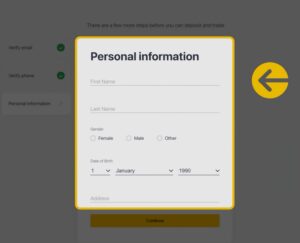

Account Types and Minimum Deposit

The structure of accounts differs widely. Exness offers more technical variety, while eToro keeps things simple with a single standard account.

| Feature | Exness | eToro |

| Account Options | Standard, Raw Spread, Zero, Pro | One account type |

| Minimum Deposit | From $10 (varies by payment method) | $100–$200 depending on region |

| Demo Account | Yes | Yes |

Traders who want flexible execution models often lean toward Exness, while newcomers may appreciate eToro’s simplicity.

Trading Platforms and Tools

The trading interface often determines how quickly orders can be placed and how efficiently strategies can be tested.

Exness:

- Provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- These platforms are favored by algorithmic traders due to Expert Advisors (EAs), advanced charting, and custom indicators.

- VPS hosting is available for stable algorithm execution.

- Analytical tools: economic calendar, trading calculators, and performance statistics.

eToro:

- Operates on a proprietary platform, accessible via web and mobile.

- Well known for its CopyTrading feature, which allows users to mirror strategies from experienced traders.

- Offers CopyPortfolios, which group assets into managed baskets.

- Analytical depth is lighter compared to MT4/MT5, but user-friendliness is a key advantage.

Payment Methods and Withdrawals

Funding options influence how efficiently traders can move capital. Here both brokers have significant differences.

Exness:

- Bank cards

- Electronic wallets (Skrill, Neteller, WebMoney)

- Local payment systems depending on region

- Instant withdrawals in many cases without manual processing

eToro:

- Bank cards

- Bank transfers

- PayPal and Skrill

- Withdrawals usually processed within 1–3 business days

- $5 withdrawal fee

User Experience and Accessibility

How a broker handles account management, interface usability, and regional access plays a decisive role in long-term satisfaction.

- Exness offers multilingual support, account management tools, and strong focus on execution speed. It is available in many regions but not licensed in the U.S.

- eToro is active in more than 100 countries, including U.S. registration. The social trading community adds a layer of interaction for beginners who want to learn by copying.

- Mobile apps from both brokers are stable, but eToro’s proprietary interface is designed for intuitive navigation, while Exness keeps the standard MT4/MT5 layout.

Pros and Cons of Exness vs eToro

Every broker has advantages and limitations, and outlining them side by side helps clarify which fits different trading styles.

Exness Pros:

- Ultra-tight spreads and low commissions on professional accounts

- Multiple account types with flexible leverage

- Fast execution and instant withdrawals for many payment methods

- MetaTrader 4 and MetaTrader 5 support for algorithmic trading

- Transparency in fee structure and trade reporting

Exness Cons:

- Limited asset classes beyond forex and CFDs

- No access to real stocks or ETFs

- Not available in the United States

eToro Pros:

- Access to real stocks, ETFs, and cryptocurrencies

- Strong social trading features (CopyTrading, CopyPortfolios)

- Regulated in multiple major jurisdictions, including the U.S.

- User-friendly proprietary platform, easy for beginners

- Commission-free stock investing

eToro Cons:

- Spreads are wider on forex compared to Exness

- $5 withdrawal fee and slower processing

- Fewer advanced tools for algorithmic or high-frequency trading

- No MetaTrader compatibility

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs

Which broker is better for forex trading?

Exness usually offers lower spreads and more account types designed for currency trading, making it attractive for forex-focused traders.